AFM Notes Pdf – Advanced Financial Management VTU Download Free Lecture Notes

Overview of Advanced Financial Management | PDF, Syllabus, Books, Question papers | B Tech (2025)

Advanced Financial Management (AFM) is an important subject for B.Tech students, especially those specializing in finance. The subject delves into various advanced concepts of managing an organization’s finances, focusing on working capital management, cash flow forecasting, receivables management, inventory control, capital structure decisions, and dividend policies. These notes are designed to provide comprehensive insights and help students excel in their exams.

The Following Topics are Covered in Advanced Financial Management Handwritten Notes

- Working Capital Management

- Cash Management

- Receivables Management

- Inventory Management

- Capital Structure Decisions

- Dividend Policy

- Special Issues in Financial Management

Links to Download AFM Notes Pdf

- Unit 1: [Link – Unit 1]

- Unit 2: [Link – Unit 2]

- Unit 3: [Link – Unit 3]

- Unit 4: [Link – Unit 4]

- Unit 5: [Link – Unit 5]

- Unit 6: [Link – Unit 6]

- Unit 7: [Link – Unit 7]

- Complete Notes: [Link Complete Notes]

Advanced Financial Management Notes and Study Material PDF Free Download (2024)

Our AFM notes and study materials are Expertly compiled to cater to the academic needs of B.Tech students. They are free downloadable, providing easy access to essential study resources.

Topics Covered in This AFM Notes Pdf

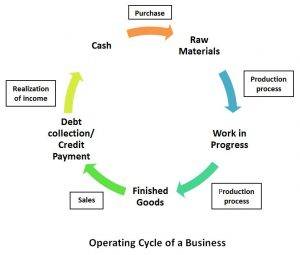

MODULE – 1: Working Capital Management

- Determination of the level of current assets

- Sources for financing working capital

- Bank finance for working capital (No problems on the estimation of working capital)

- Working capital financing: Short-term and long-term financing

- Working capital leverages

MODULE – 2: Cash Management

- Forecasting cash flows

- Cash budgets and long-term cash forecasting

- Monitoring collections and receivables

- Optimal cash balances – Baumol model, Miller-Orr model, and Stone model

- Strategies for managing surplus funds

MODULE – 3: Receivables Management

- Credit management through credit policy variables

- Marginal analysis and credit evaluation

- Numerical credit scoring and discrimination analysis

- Control of accounts receivables

- Factoring

MODULE – 4: Inventory Management

- Determination of inventory control levels: Ordering, reordering, danger level

- Economic Order Quantity (EOQ) model

- Pricing of raw materials

- Monitoring and control of inventories

- ABC Analysis

MODULE – 5: Capital Structure Decisions

- Capital structure & market value of a firm

- Theories of capital structure: NI approach, NOI approach, Modigliani-Miller approach, traditional approach

- Arbitrage process in the capital structure

- Planning the capital structure: EBIT and EPS analysis

- ROI & ROE analysis

- Capital structure policy

MODULE – 6: Dividend Policy

- Theories of dividend policy: relevance and irrelevance dividend decision

- Walter’s & Gordon’s model, Modigliani-Miller approach

- Dividend policies: stable dividend, stable payout, and growth

- Bonus shares and stock splits

- Corporate dividend behavior

- Legal and procedural aspects of dividends

- Corporate Dividend Tax

MODULE – 7: Special Issues in Financial Management

- Corporate financial modeling

- Agency problems and considerations

- Effect of inflation on asset value, firm value, and returns

- Financial planning: Basis of financial planning, sales forecast method, Pro-forma P & L account method, Pro-forma balance sheet method

- Determination of External Financing Requirement (EFR)

AFM Notes Pdf from VTU

These notes are tailored for students, ensuring they cover the complete syllabus per the university guidelines. The detailed explanations and illustrative examples will aid in better understanding and retention of concepts.

Always Choose Smartzworld to Download AFM Notes PDF

Smartzworld is your reliable source for free, high-quality educational resources. By choosing Smartzworld, you ensure access to the latest and most comprehensive notes, all tailored to help you succeed in your academics.

Benefits of FREE AFM Handwritten Notes PDF

- Comprehensive Coverage: These notes cover all essential topics in the Advanced Financial Management syllabus, ensuring you don’t miss out on any critical areas.

- Easy Accessibility: Download the notes at your convenience and access them anytime, anywhere.

- Exam Preparation: These notes are designed to help you prepare thoroughly for your exams, with clear explanations and key points highlighted.

- Quality Content: Handwritten notes provide a personal touch and are often easier to understand and remember.

Conclusion

The Advanced Financial Management notes provided here are an invaluable resource for B.Tech students. They cover all necessary topics comprehensively, ensuring you are well-prepared for your exams. Download the notes now and start your journey towards mastering advanced financial management.

FAQs

Q1.Where can I download the Advanced Financial Management Notes Pdf?

- You can download the notes from the provided links for each unit or the complete set from Smartzworld.

Q2.How to download the AFM Notes Pdf?

- Click on the respective links provided for each unit or the complete set to download the notes.

Q3.How many modules are covered in AFM Notes Pdf?

- The AFM notes cover a total of seven modules.

Q4.Topics Covered in AFM Notes Pdf?

- The topics covered include Working Capital Management, Cash Management, Receivables Management, Inventory Management, Capital Structure Decisions, Dividend Policy, and Special Issues in Financial Management.

Q5.Where can I get the complete AFM Handwritten Notes pdf FREE Download?

- You can get the complete AFM handwritten notes for free download from Smartzworld.

Q6.How to download AFM Handwritten Notes pdf?

- Simply click on the link provided for the complete set of notes to download the AFM handwritten notes in PDF format.

Q7.How to Download FREE AFM Notes PDF?

- Visit the Smartzworld website and click on the links provided for each unit or the complete set to download the free AFM notes PDF.

Download the Advanced Financial Management Question Paper

Download Now(Link )

Download ALL SUBJECTS- B Tech 2025 Study Material

Download Now(Link )

References

- VTU University Syllabus for Advanced Financial Management

- Smartzworld, Advanced Financial Management Notes and Study Materials

- Baumol, W. J. (1952). The Transactions Demand for Cash: An Inventory Theoretic Approach.

- Miller, M. H., & Orr, D. (1966). A Model of the Demand for Money by Firms.

- Modigliani, F., & Miller, M. H. (1958). The Cost of Capital, Corporation Finance, and the Theory of Investment.

- Gordon, M. J. (1962). The Investment, Financing, and Valuation of the Corporation.